The Main Principles Of Offshore Wealth Management

Wiki Article

Some Known Details About Offshore Wealth Management

Table of ContentsOffshore Wealth Management Things To Know Before You BuySome Known Facts About Offshore Wealth Management.The Only Guide for Offshore Wealth ManagementSome Ideas on Offshore Wealth Management You Should KnowOur Offshore Wealth Management Statements

Offshore investing is often demonized in the media, which paints a picture of tax-evading investors illegally stashing their money with some questionable company located on a rare Caribbean island. While it holds true that there will always be circumstances of cheats, the large majority of overseas spending is flawlessly lawful.

For a small country with very few resources and a little populace, drawing in financiers can drastically enhance financial task. Put simply, offshore financial investment happens when overseas capitalists create a firm in an international nation. The firm serves as a shell for the investors' accounts, shielding them from the greater tax obligation concern that would be sustained in their house nation.

By making these on-paper possession transfers, people are no more vulnerable to seizure or other residential troubles. If the trustor is a united state citizen, their trustor status allows them to make contributions to their overseas count on without income tax obligation. The trustor of an offshore asset-protection fund will still be exhausted on the trust fund's earnings (the revenue made from investments under the trust entity), also if that earnings has not been dispersed.

Unknown Facts About Offshore Wealth Management

These countries have established legislations developing stringent corporate and banking confidentiality. This privacy doesn't imply that offshore capitalists are lawbreakers with something to conceal.

Due to the fact that countries are not needed to approve the legislations of an international federal government, offshore territories are, in a lot of instances, immune to the legislations that might use where the capitalist stays. United state courts can insist jurisdiction over any possessions that are located within United state

The 6-Minute Rule for Offshore Wealth Management

Therefore, for that reason is prudent to be sure that the assets a possessions is capitalist to trying not be held physically in the United States - offshore wealth management.Offshore accounts are much extra adaptable, offering financiers unrestricted access to international markets and to all major exchanges. China's desire to privatize some markets, in certain, has financiers drooling over the world's biggest consumer market.

While domiciling investments as well as possessions in an overseas territory has advantages, there are additionally drawbacks to think about. In recent times, the united state government has ended up being progressively conscious of the tax obligation profits click for more info lost to offshore investing and also has actually created more specified as well as restrictive legislations that close tax obligation loopholes. Investment income gained offshore is now a focus of both regulators and also tax obligation laws.

As a result, although the reduced corporate expenses of overseas firms can equate right into far better gains for investors, the internal revenue service keeps that united state taxpayers are not to be enabled to evade tax obligations by changing their individual tax obligation liability to some international entity. The Organization for Economic Teamwork and Growth (OECD) and also the Globe Profession Company (WTO) additionally have guidelines that call for banks to report details concerning their international clients, however each nation abides by these laws in different ways and also to different degrees.

The smart Trick of Offshore Wealth Management That Nobody is Talking About

Offshore accounts are not economical to set up. Depending on the person's financial investment objectives as well as the jurisdiction they select, an offshore corporation might need to be started, which may indicate steep legal costs as well as business or account enrollment fees. Sometimes, investors are needed to own residential property (a residence) in the nation in which they have an offshore account or run a holding business.Even more why not find out more than half the globe's possessions as well as investments are held in overseas territories. Numerous well-recognized companies have investment possibilities in overseas locales.

If you are aiming to offshore financial investments to assist protect your assetsor are interested in estate planningit would be sensible to locate a lawyer (or a group of lawyers) concentrating on property defense, wills, or service sequence. You require to check out the financial investments themselves as well as their legal as well as tax effects.

In many cases, the advantages of offshore investing are outweighed by the tremendous costs of specialist go to this web-site fees, compensations, and also traveling costs.

All About Offshore Wealth Management

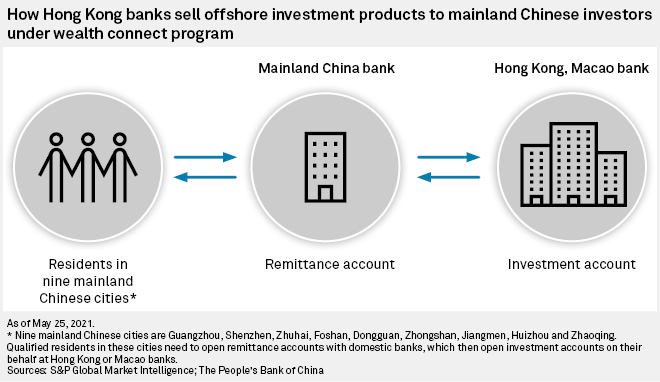

Worldwide investors intending to tailor up their properties, wide range, and investments like to proceed ahead with overseas investments. The offshore industry gives exceptional adaptability to worldwide investors to come forward and also spend in offshore wide range monitoring.This overview will certainly help you to comprehend the core fundamentals required for overseas wealth administration. Offshore investment transforms out to be among the driving tools that has actually been widely selected by company investors around the world. Because company investors have widely accepted the idea over a duration, the majority of nations have actually changed themselves right into preferred overseas territories.

Report this wiki page